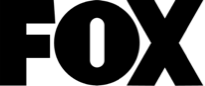

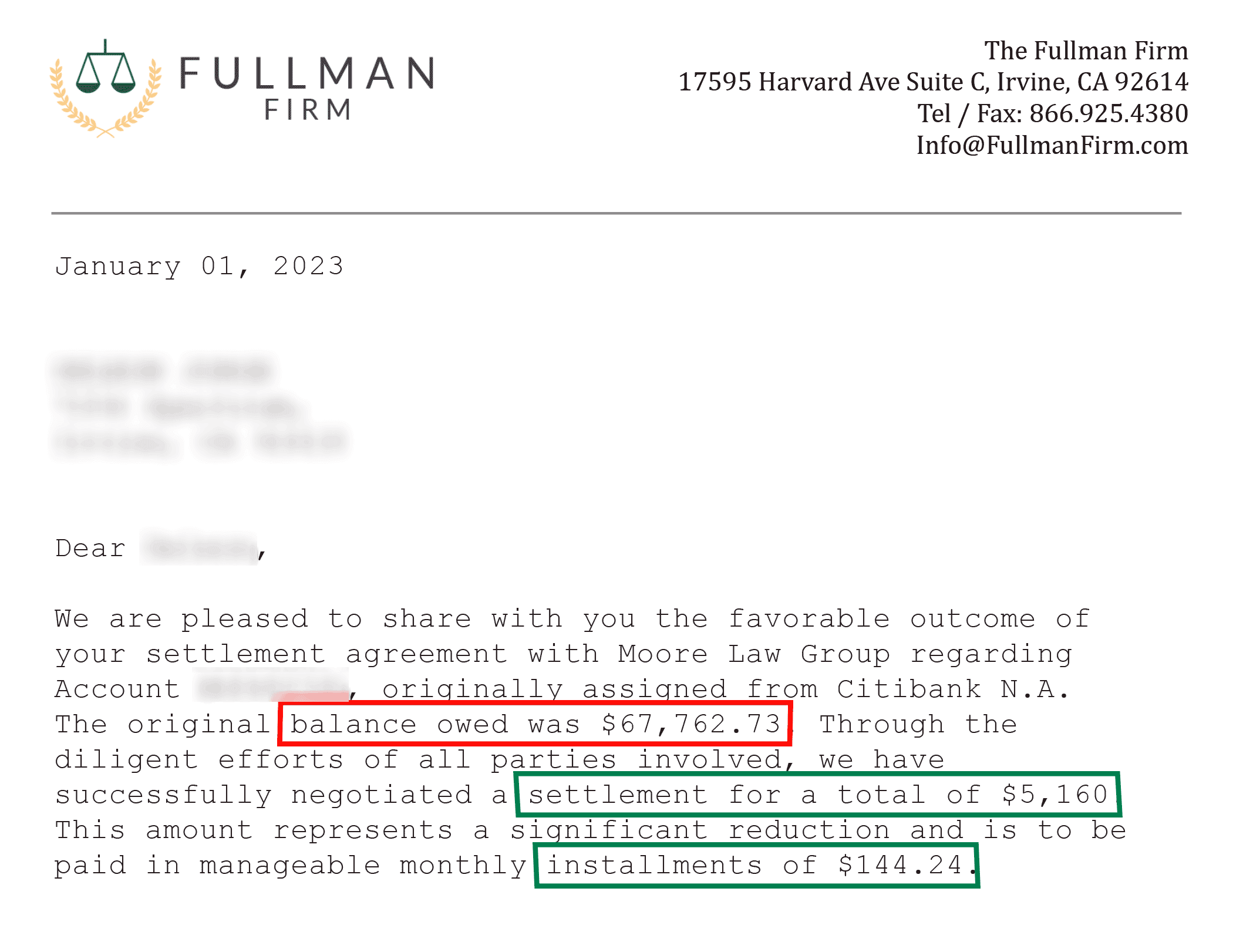

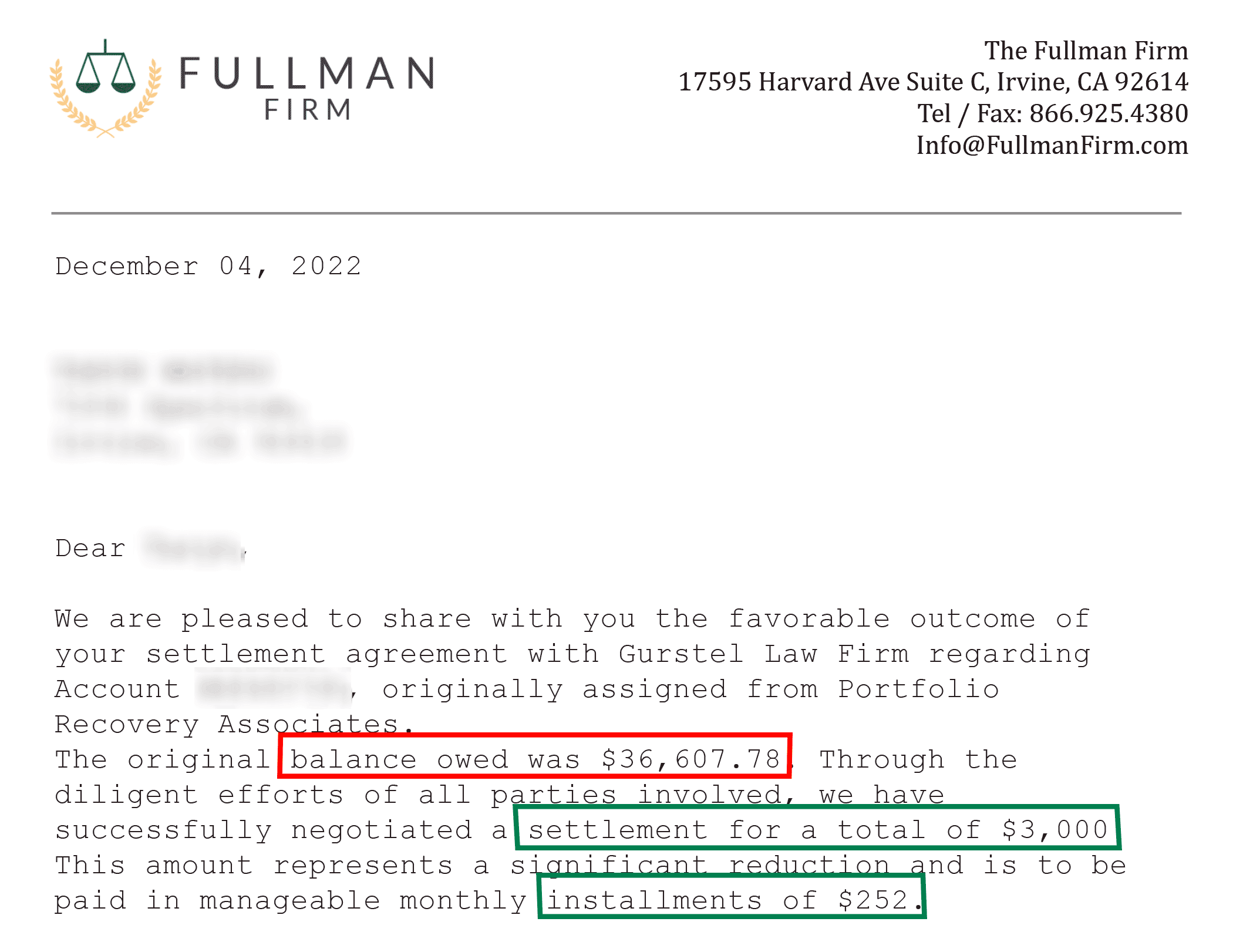

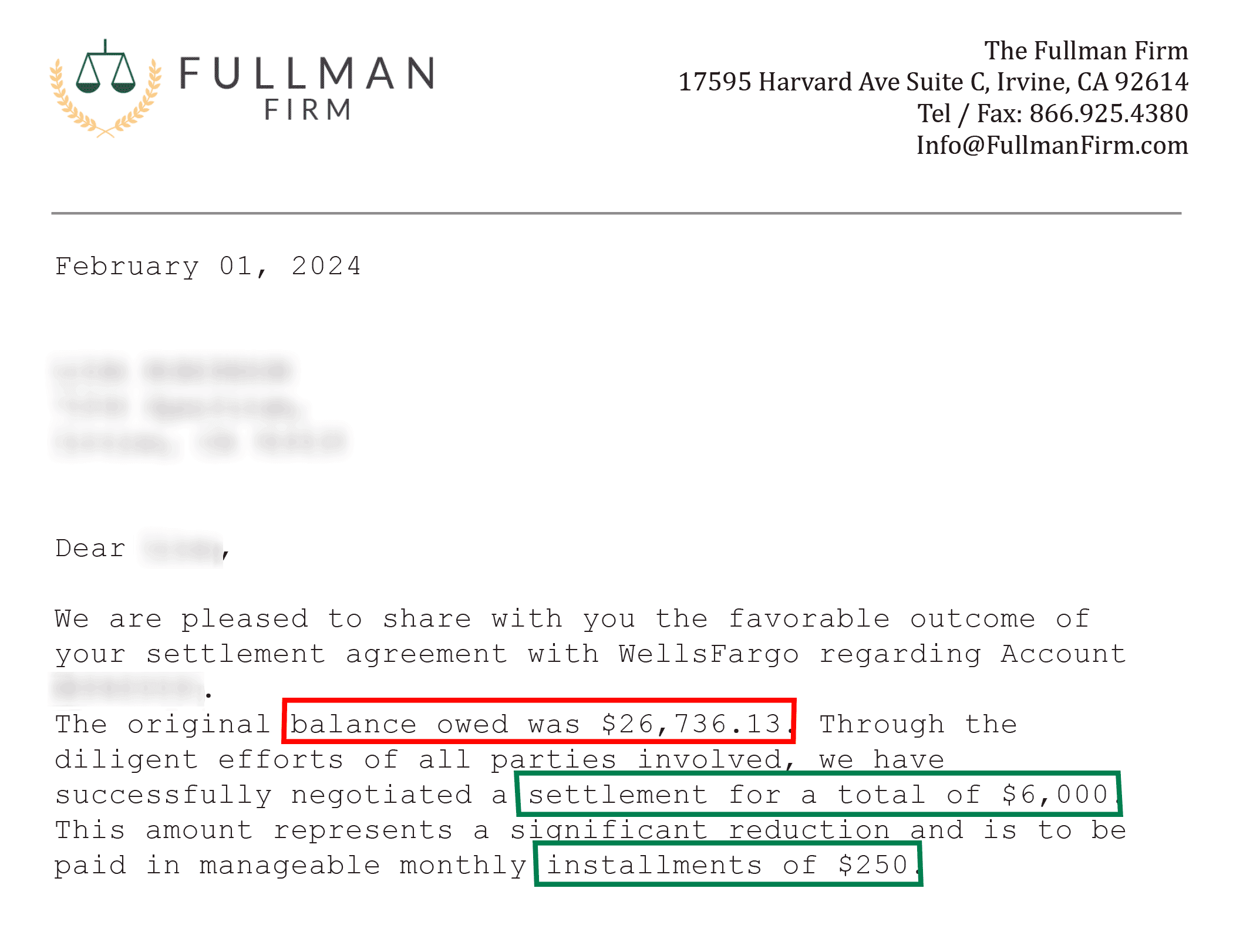

Success Stories

What if I am Being Sued

by Creditors in California?

If you are being sued by a creditor, it is important to act quickly. If you ignore any legal papers that are sent to you by a credit card company or a bank, the court will issue a default judgment. This means that you are legally responsible for the debt and the creditor can go after your bank accounts, garnish your wages or place a lien on your property.

At the Fullman Firm, we will choose the best plan of attack. Our experienced credit defense lawyers will prepare a response and demand that the creditor provide evidence that the debt is actually yours. You should also know that there are state and federal laws that protect you from aggressive collection practices. Our credit defense attorneys will determine if your rights under these laws have been violated and help you decide whether to settle or fight the lawsuit in court. We will help you explore all your options so that you can make the best decisions about your financial future.

Very professional and Sam Dehbozorgi is an absolute fighter... If you are facing a significant lawsuit you must go with The Fullman Firm. When you get served immediately call them to get the best legal advice possible... The Fullman Firm knows how to attack these crooked organizations. Without hesitation reach out so they could immediately answer the complaint. The Fullman Firm knows the legal process specifically for California consumer law.

— Marlon V.

California Consumer Protection Law Firm

The Fullman Firm is a premier consumer protection and credit defense practice serving clients throughout California. Our experienced collection defense lawyers are dedicated to defending individuals against all types of creditor lawsuits. Founding attorney Adam Fullman is a highly regarded consumer advocate with a passion for helping everyday people fight back against credit card companies, banks, and other financial institutions.

We charge a small flat fee and we only earn a profit if we are able to save you money. We are willing to put our money where our mouth is and put our skin in the game with you.

We are excited to announce a new payment option for our clients: ClientCredit. Powered by LawPay, ClientCredit is a flexible legal fee lending solution with no hidden fees and no surprises. CALL US now to discuss your options. Checking if you prequalify or applying for a loan through Affirm does NOT affect your credit. This allows you to hire us immediately to solve your debt problems, while giving you flexible repayment options.

At the Fullman Firm, we are dedicated to protecting consumers against the unfair and deceptive practices of creditors. While they may have an unfair advantage over consumers, we know how to level the playing field. If you are facing a creditor lawsuit, a wage garnishment, a default judgment, a bank levy, or a lien on your property, we have the skills and experience to help you fight back.