Have You Been Sued by a Debt Collector?

If you’ve been sued by a creditor, it’s important to understand your rights and the steps you can take to protect yourself. Debt lawsuits can be stressful and overwhelming, but the experienced debt settlement lawyers at Fullman Firm are here to help. We have years of experience representing individuals and businesses facing debt lawsuits, and we’re committed to helping our clients reach the best possible outcome.

What is a Debt Lawsuit?

A debt lawsuit is a legal action taken by a creditor to collect on an unpaid debt. If you’ve fallen behind on your payments, the creditor may sue you in court to get a judgment against you. This judgment can result in wage garnishments, bank account levies, and even the seizure of your assets.

Timeline of Events When Being Sued by a Debt Collector

The timeline of a debt lawsuit typically includes the following events:

- Debt Collection Attempts: A creditor will usually make multiple attempts to collect payment through phone calls, letters, or emails.

- Pre-Lawsuit Demand Letter: If debt collection attempts are unsuccessful, a creditor may send a pre-lawsuit demand letter that outlines the amount owed and demands payment.

- Filing of a Lawsuit: If the debt remains unpaid, the creditor may file a lawsuit in court. The creditor must prove that the debt is owed and that they have the right to sue for payment.

- Service of Process: After a lawsuit has been filed, the defendant (the person being sued) must be legally served with a copy of the complaint and a summons to appear in court.

- Response to the Complaint: The defendant has a limited amount of time to respond to the complaint, typically 30 to 40 days depending on the method of service. Filing a “Response” must be pursuant to the California Law. In other words, a letter does not satisfy the requirements of a Responsive Pleading and may result in a default judgment being entered against the Defendant.

- Discovery: This stage involves exchanging information between the plaintiff (the person suing) and the defendant. This may include written questions (interrogatories), requests for documents, and depositions.

- Pretrial Hearings: The parties may attend pretrial hearings to resolve any disputes or request relief before trial.

- Trial: If the case cannot be resolved, it may go to trial. The judge or a jury will hear the evidence and make a determination on the debt.

- Judgment: If the creditor prevails in court, a judgment will be entered in their favor, ordering the defendant to pay the debt.

- Collection: If the defendant does not pay the debt, the creditor may use various collection methods such as wage garnishment, bank levy, or property seizure to collect the debt.

It’s important to understand that the timeline and process of a debt collection lawsuit can vary depending on the jurisdiction, the amount of debt, and other factors. Seeking the advice of an experienced debt settlement attorney can help you navigate the legal process and protect your rights.

What Happens When You’re Sued by a Debt Collector?

When you’re sued by a debt collector, you’ll receive a summons and complaint, which will explain the creditor’s claim against you. You’ll typically have a limited amount of time to respond to the lawsuit, usually 30-40, depending on the method of service. In California, you have 30 days to file a responsive pleading if you have been personally served with the summons and complaint (i.e. if the lawsuit documents were handed to you personally). If you fail to respond, the creditor may obtain a default judgment against you.

Default Judgment Consequences

A default judgment is a court order that results when a defendant does not respond to a debt lawsuit or does not appear in court. If a creditor obtains a default judgment against you, it may lead to several consequences that can significantly impact your financial well-being. Some of the consequences include:

Wage Garnishment: A creditor may be able to garnish your wages, which means a portion of your salary will be automatically deducted to repay your debt. The amount that can be garnished is limited by federal and state law, but it can still have a significant impact on your finances.

Bank Levy: A creditor may also be able to obtain a bank levy, which allows them to freeze your bank account and seize funds to repay your debt. This can lead to an interruption in your normal financial activities and result in overdraft fees and other charges.

Lien on Property: A creditor may place a lien on your property, which means that your assets will be used to repay your debt if you sell them. This can make it difficult to sell property and get the full value for it.

Interest on judgment: A default judgment will continue to accrue interest so long as it’s unpaid. For example, in California a default judgment will accrue interest at a rate of 10% per year. The experienced debt relief attorneys at The Fullman Firm can help you settle a judgment once and for all.

Are You Exempt From Wage Garnishment?

Depending on your state laws and the amount you owe, you may be considered “judgment proof” and exempt from wage garnishment.

At The Fullman Firm, our team of experienced debt settlement lawyers offer free consultations to help you understand your rights and options. Don’t wait to take control of your financial situation and protect your assets. Contact us today for a free, no-obligation consultation.

What NOT to Do when being sued by a debt collector?

If you are facing a lawsuit from a creditor, it’s important to understand your rights and take appropriate action. However, there are certain actions that can worsen the situation or harm your chances of resolving the debt in a favorable way. Here are some things to avoid when you are being sued by a debt collector.

Do NOT Ignore the Lawsuit

One of the biggest mistakes you can make when facing a debt lawsuit is ignoring it. Failing to respond to a lawsuit can lead to a default judgment against you, which means the creditor wins the case by default. The court may then issue a wage garnishment order or seize your bank accounts to pay off the debt.

Do NOT Admit Guilt

Another important thing to avoid when being sued by a debt collector is admitting guilt. Admitting guilt can give the creditor more leverage in the lawsuit and make it more difficult for you to negotiate a favorable settlement. Instead, consider hiring a debt settlement lawyer to represent you in court and help you navigate the legal process.

Be Wary of Unscrupulous Debt Relief Services

There are many companies that claim to be able to help you settle your debt for less, but many of these services are scams. Some of these companies may take your money and do nothing to help you settle the debt, while others may make your situation worse. Be sure to research any debt relief service before using it, and consider working with a reputable debt settlement law firm like Fullman Firm.

Don’t Give In to Impulsive Decisions

When a debt collector contacts you and demands payment immediately, it’s important to remain calm and collected. Don’t agree to anything or provide personal information over the phone without verifying the validity of the debt first. Request a debt validation letter or proof of the lawsuit in writing before proceeding.

Avoid hasty decisions and take the time to verify information. A legitimate debt collector should have no problem providing documentation to support their claims. To protect yourself from debt collection scams, you can hang up the phone and call back using the contact information found online or through the local Secretary of State to ensure that you are speaking with a legitimate company.

Red Flags of a Debt Collection Scam

There are certain warning signs to look out for that may indicate a debt collection scam. Some of these include:

- Emails from generic email domains, such as @gmail.com or @yahoo.com

- Unusual or unbelievable claims, such as a debt collector stating that immigration or the police will be coming for you

- Pressure to pay using an unconventional method, such as a prepaid credit card or money transfer

If you encounter any of these warning signs, it’s best to be cautious and not proceed with any payment until you have thoroughly verified the validity of the debt.

Is it Possible to Settle a Debt After Receiving a Summons?

Yes, you can settle a debt after being served with a lawsuit by a creditor. In fact, settling a debt after being served is often a more favorable outcome compared to letting the debt go to court. This is because settling allows you to reach an agreement with the creditor on the terms of repayment, potentially lowering the amount you owe, and avoiding a costly and time-consuming court battle.

When you settle a debt after being served, it’s important to have a clear understanding of your financial situation, the amount of debt you owe, and the terms of the settlement agreement. You may also want to consider seeking the advice of an experienced debt settlement attorney to ensure that your rights and interests are protected throughout the process.

The settlement process typically involves negotiations between you and the creditor or debt collector, during which you’ll agree on a reduced amount to repay the debt.

Things to Consider When Hiring a Debt Settlement Lawyer

Hiring a debt settlement lawyer can be a smart choice to help you navigate the legal process and negotiate a resolution with your creditors. However, not all debt settlement lawyers are created equal, and it’s important to do your research and choose a lawyer who has the experience, reputation, and skills to best represent your interests. Here are some things to consider when hiring a debt settlement lawyer:

Experience and Track Record – Look for a debt settlement lawyer who has a proven track record of helping clients resolve their debt disputes. Check their website, read reviews, and ask for references to get a sense of their experience and reputation in the field.

Open Channels of Communication – A good debt settlement lawyer should be a strong communicator and be able to explain the legal process and your options in a clear and concise manner. They should also be accessible and responsive to your questions and concerns.

Understanding of the Law – Look for a debt settlement lawyer who has a deep understanding of the debt collection laws in your state and has experience negotiating with creditors and representing clients in court.

Cost and Payment Terms – The cost of hiring a debt settlement lawyer can vary widely, so it’s important to understand their fees, payment terms, and what services are included in their fees. Be wary of lawyers who charge upfront fees or make promises of guaranteed results. Here at Fullman Firm OUR FEES ARE SIMPLE, TRANSPARENT & FLEXIBLE! We charge a small flat fee and we only earn a profit if we are able to save you money. We are willing to put our money where our mouth is and put our skin in the game with you. The more we save you, the more we earn.

Ethical Standards – Check the lawyer’s professional record with your state bar association to ensure they have a good reputation and haven’t been the subject of any disciplinary actions.

By taking the time to research and choose the right debt settlement lawyer, you can increase your chances of resolving your debt dispute successfully and with the least amount of stress and disruption to your life.

What are the Advantages of Working with The Fullman Firm?

At The Fullman Firm, we understand the complex legal and financial issues involved in debt lawsuits. Our experienced debt settlement lawyers are dedicated to helping our clients achieve the best possible outcome, and we’re committed to providing personalized, hands-on representation.

We know that being sued by a creditor or debt collector can be a stressful and overwhelming experience, and that’s why we’re here to help. We’ll guide you through every step of the process, and we’ll be there to answer any questions you may have.

Contact Us Today

If you’ve been sued by a creditor or debt collector, don’t wait. Contact the experienced debt settlement lawyers at The Fullman Firm today to schedule a consultation and learn more about your options. We’re here to help, and we’re dedicated to helping you reach the best possible outcome.

What Should You Do After Being Sued By A Debt Collector?

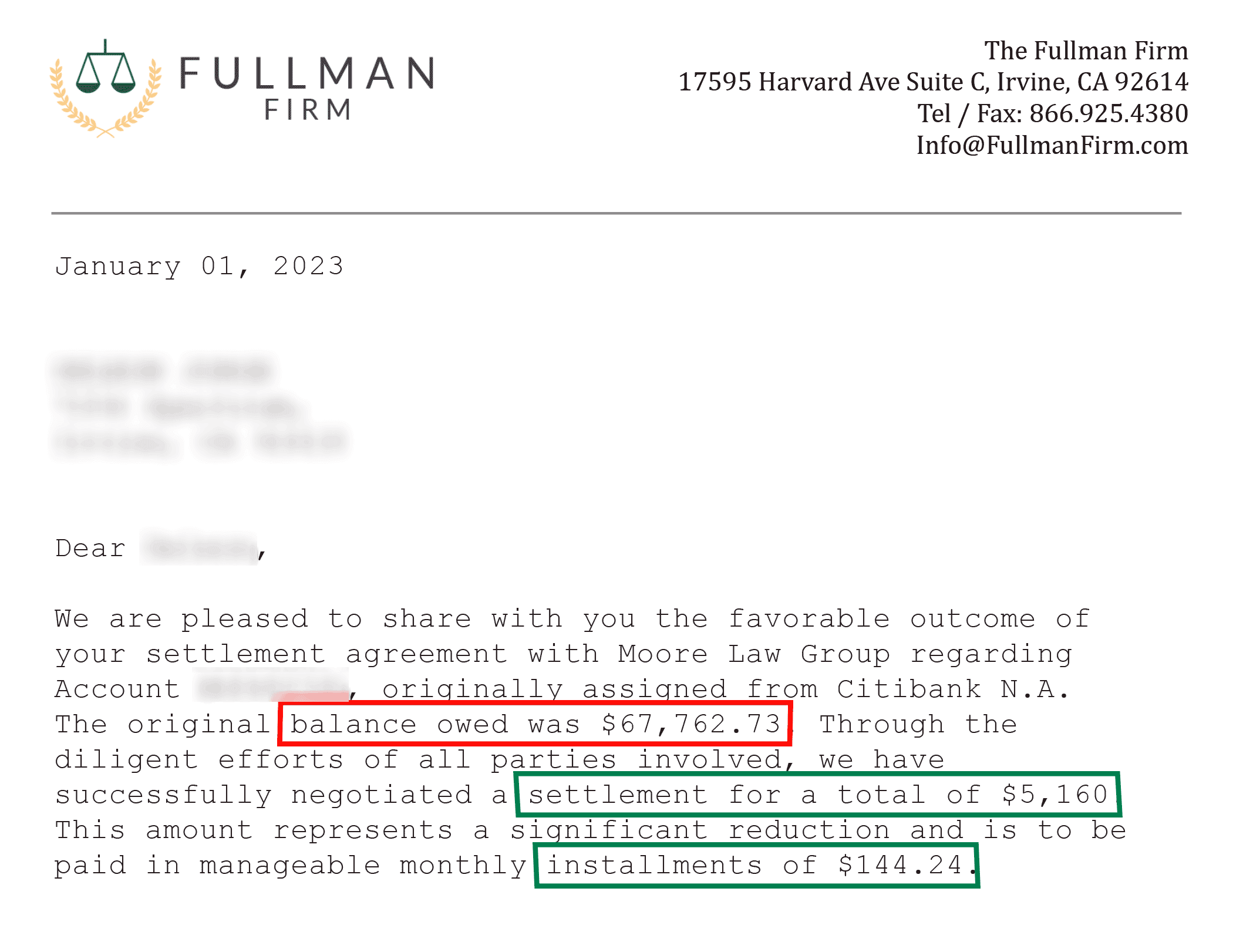

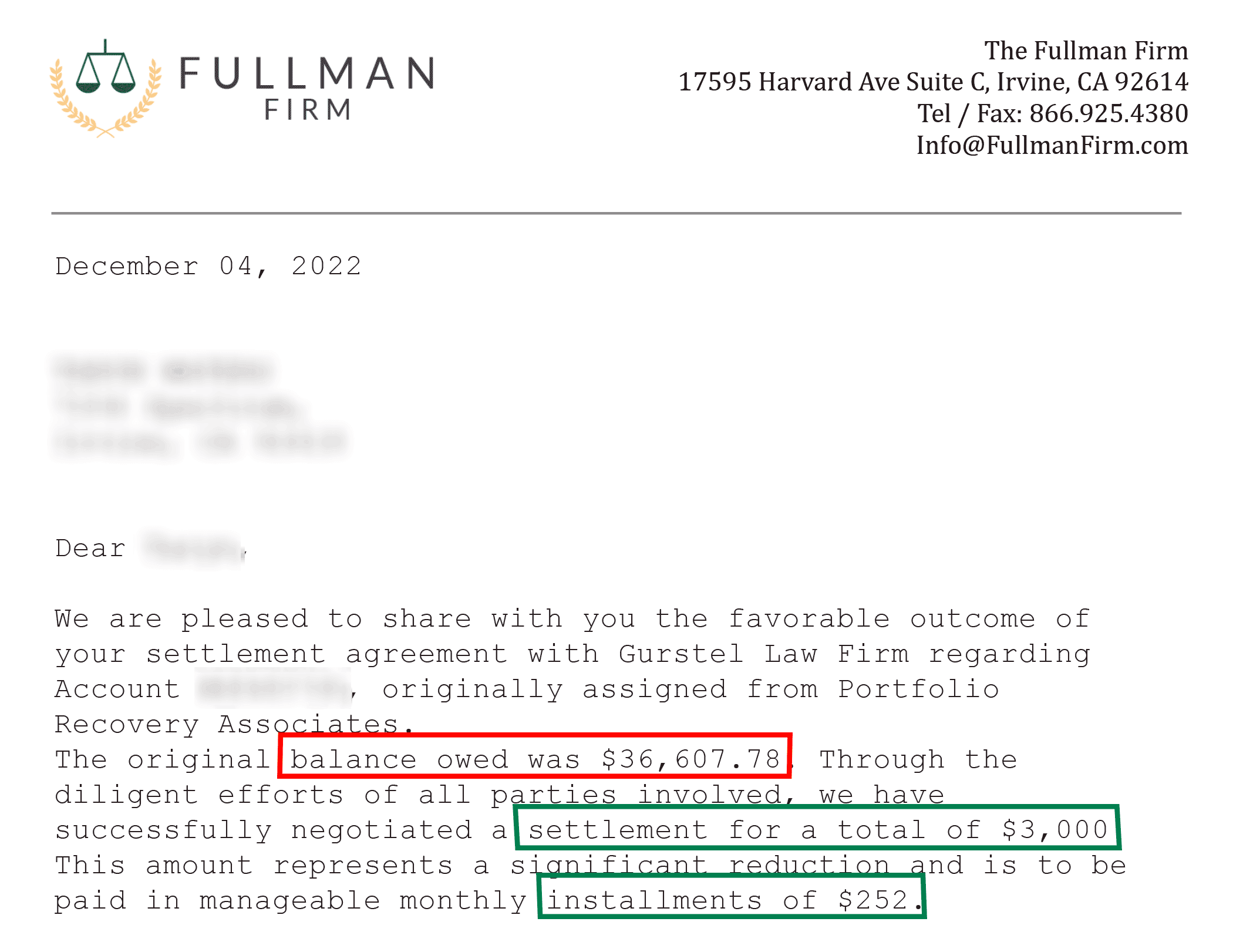

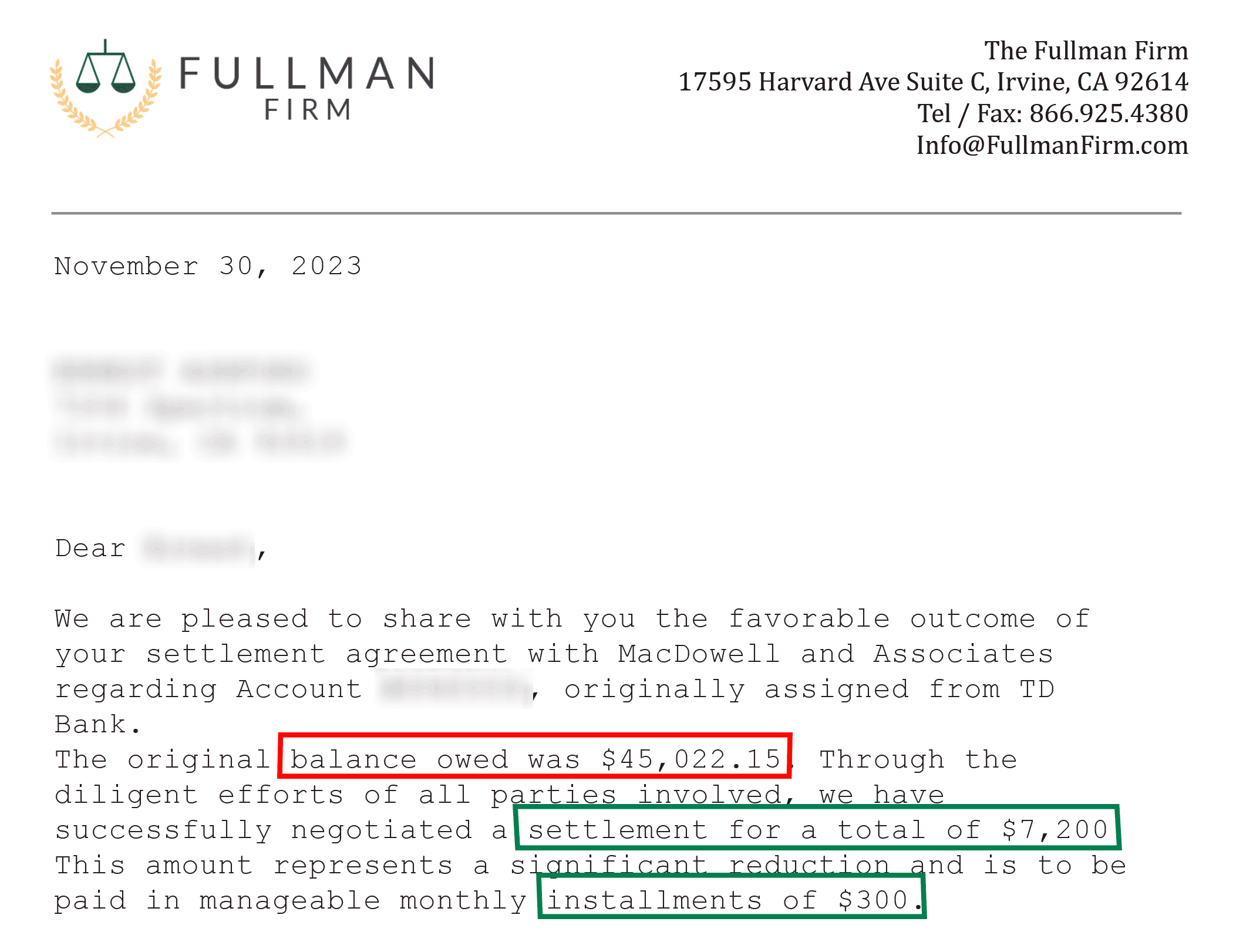

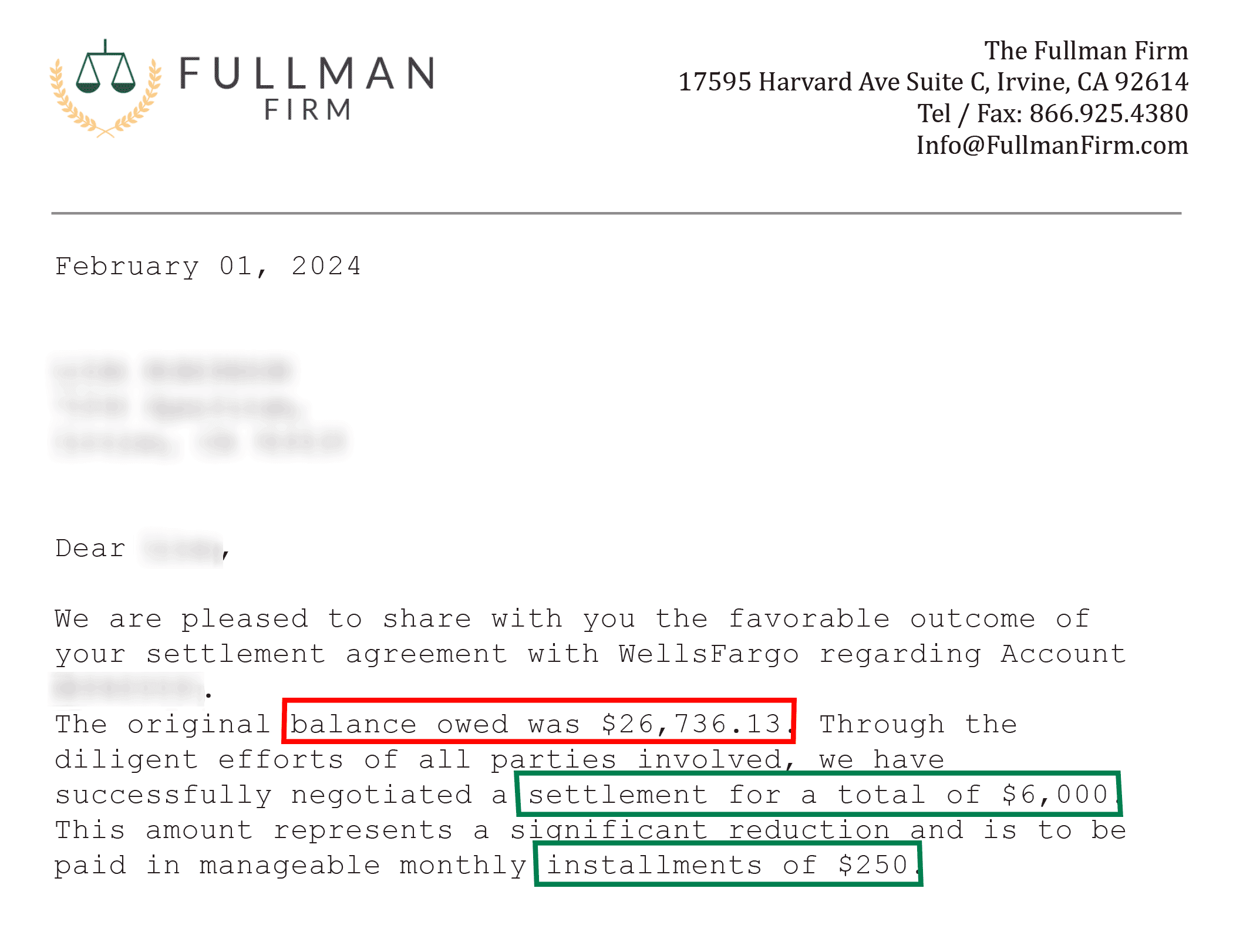

Success Stories

We charge a small flat fee and we only earn a profit if we are able to save you money. We are willing to put our money where our mouth is and put our skin in the game with you.

We are excited to announce a new payment option for our clients: ClientCredit. Powered by LawPay, ClientCredit is a flexible legal fee lending solution with no hidden fees and no surprises. CALL US now to discuss your options. Checking if you prequalify or applying for a loan through Affirm does NOT affect your credit. This allows you to hire us immediately to solve your debt problems, while giving you flexible repayment options.