If you have received a notice of renewal of judgment, you may be feeling overwhelmed and unsure of what to do next. The renewal of judgment means that the creditor can take legal action to collect the debt, including wage garnishment, bank levy, and even property foreclosure. At Fullman Firm, our attorneys are dedicated to helping you understand the process and take action to protect your financial interests.

According to a recent study, over 2 million judgments are renewed each year. Of these, approximately 20% result in wage garnishment, 10% result in bank account seizure, and 5% result in property foreclosure. These statistics highlight the importance of taking action as soon as possible when faced with a renewal of judgment.

Here Are Some Facts About Notice of Renewal of Judgment

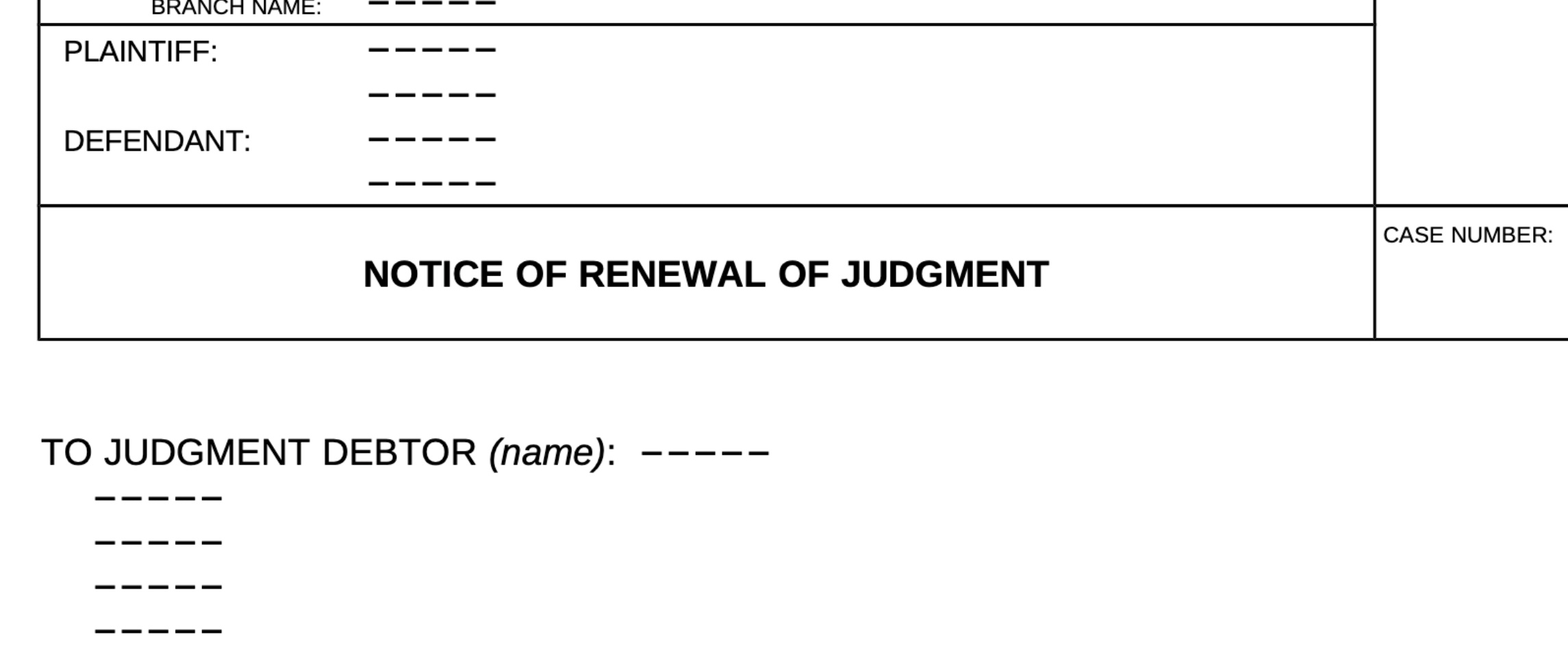

- A notice of renewal of judgment is a legal document that is filed by the creditor when they wish to renew a judgment against a debtor, this document must be properly served to the debtor, and it is important to respond to the notice in a timely manner.

- The renewal of judgment allows the creditor to take legal action to collect the debt, including wage garnishment, bank levy, and even property foreclosure. This can be done by enforcing the judgment through court orders such as garnishment, levying on bank accounts, and foreclosing on property.

- Debtor has a certain amount of time to respond to the notice of renewal of judgment, this is known as the statute of limitations, the time limit varies from state to state and also it depends on the type of the judgment. Failure to respond to the notice in a timely manner can result in the judgment being renewed without the debtor’s input, this means the debtor will not have the opportunity to contest the renewal.

- It is important to seek legal guidance to understand the terms of the judgment and the notice of renewal, and to negotiate a payment plan or challenge the judgment in court. An attorney can also help to ensure that any payment plan is fair and reasonable and to evaluate if the judgment is legally valid or not, also if the debtor has any legal defense against the renewal.

Some Facts About Renewal of Judgement in California

- California’s statute of limitations for renewal of judgment is 10 years. This means that a judgment can be renewed every 10 years, allowing the creditor to continue to collect the debt.

- In California, wage garnishment is limited to 25% of the debtor’s disposable earnings, this means the creditor can only garnish 25% of the debtor’s income after taxes and mandatory deductions.

- California law also limits the amount that can be levied from a debtor’s bank account. The creditor can only levy up to the amount of the judgment, plus interest and costs.

- In California, a debtor has the right to claim exemptions from garnishment and levies, which can help protect certain assets from being seized to pay off the debt.

- California law also provides for a procedure called “relief from stay” that allows the creditor to renew a judgment and foreclose on the property if the debtor is in default on a mortgage or if the property is not the primary residence of the debtor.

- In California, a debtor has the right to file an “order to show cause” in court, which can be used to contest the renewal of judgment and ask the court to set it aside if the creditor failed to follow the proper procedures, or if the judgment is no longer enforceable.

Navigating the Renewal Process with the Help of Fullman Firm

When a judgment is renewed, the creditor must file a notice of renewal with the court. This notice must be served to the debtor, who then has a certain amount of time to respond. It’s important to respond to the notice in a timely manner, as failure to do so can result in the judgment being renewed without the debtor’s input.

At Fullman Firm, our attorneys are experts in dealing with renewal of judgment and can help you understand the terms of the judgment and the notice of renewal. This includes the amount of the judgment, the interest rate, and the payment schedule. Our attorneys will also guide you through the legal rights and options available to you.

Protecting Your Finances with Fullman Firm

The renewal of judgment can have serious negative consequences for the debtor. These can include wage garnishment, bank levy, and property foreclosure. However, with the help of Fullman Firm, you can take action to protect your finances.

Our attorneys will work with you to negotiate a payment plan with the creditor, which can include a reduced payment amount or a longer repayment period. We will also help you to challenge wage garnishment and bank levy in court, and work towards a fair and reasonable outcome for you.

Free Live Legal Consultation with Fullman Firm

At Fullman Firm, we understand how important it is to receive the right legal advice, that’s why we offer a Free Live Legal Consultation with one of our attorneys, who will help you understand the notice of renewal of judgment that you have received and guide you through the next steps. Contact us today to schedule your consultation and take the first step towards protecting your financial interests.

In conclusion, a notice of Renewal of judgment can be a stressful and overwhelming experience, but with the help of Fullman Firm and our experienced attorneys, you can navigate the process and protect your financial interests. Contact us today to schedule a consultation and take the first step toward a resolution.