Facing a debt lawsuit can be overwhelming, but understanding your rights and options can make a significant difference. Here at The Fullman Firm, we specialize in helping individuals navigate through debt collection lawsuits, aiming to achieve dismissals or favorable resolutions. Here’s everything you need to know about getting a debt lawsuit dismissed and how our services can assist you:

Understanding Debt Lawsuits

Debt lawsuits typically arise when a creditor or debt collector initiates legal action against a debtor to recover unpaid debts. This legal process can lead to wage garnishment, bank account levies, or liens on property if left unaddressed.

Reasons for Dismissal

- Lack of Documentation: Creditors must provide sufficient documentation proving the debt is owed and they have the legal right to collect. A professional can leverage missing or incomplete paperwork to obtain dismissal of the lawsuit.

- Expired Statute of Limitations: In many jurisdictions, creditors must file lawsuits within a specified time frame known as the statute of limitations. If this period has passed, the lawsuit may be dismissed.

- Violation of Consumer Rights: Debt collectors must adhere to laws such as the Fair Debt Collection Practices Act (FDCPA). A professional can spot violations, such as harassment, misrepresentation, or threats, and often leverage them to get a dismissal of the collection lawsuit.

- Identity Theft: If you’re a victim of identity theft and the debt in question is fraudulent, providing evidence of identity theft can support your case for dismissal.

How The Fullman Firm Can Help

At The Fullman Firm, we offer dedicated legal services tailored to your specific situation:

- Comprehensive Legal Analysis: Our experienced attorneys will conduct a thorough review of your case, examining all documents and evidence to identify grounds for dismissal.

- Strategic Defense: We develop personalized defense strategies based on the specifics of your case, leveraging our expertise to challenge creditor claims and protect your rights.

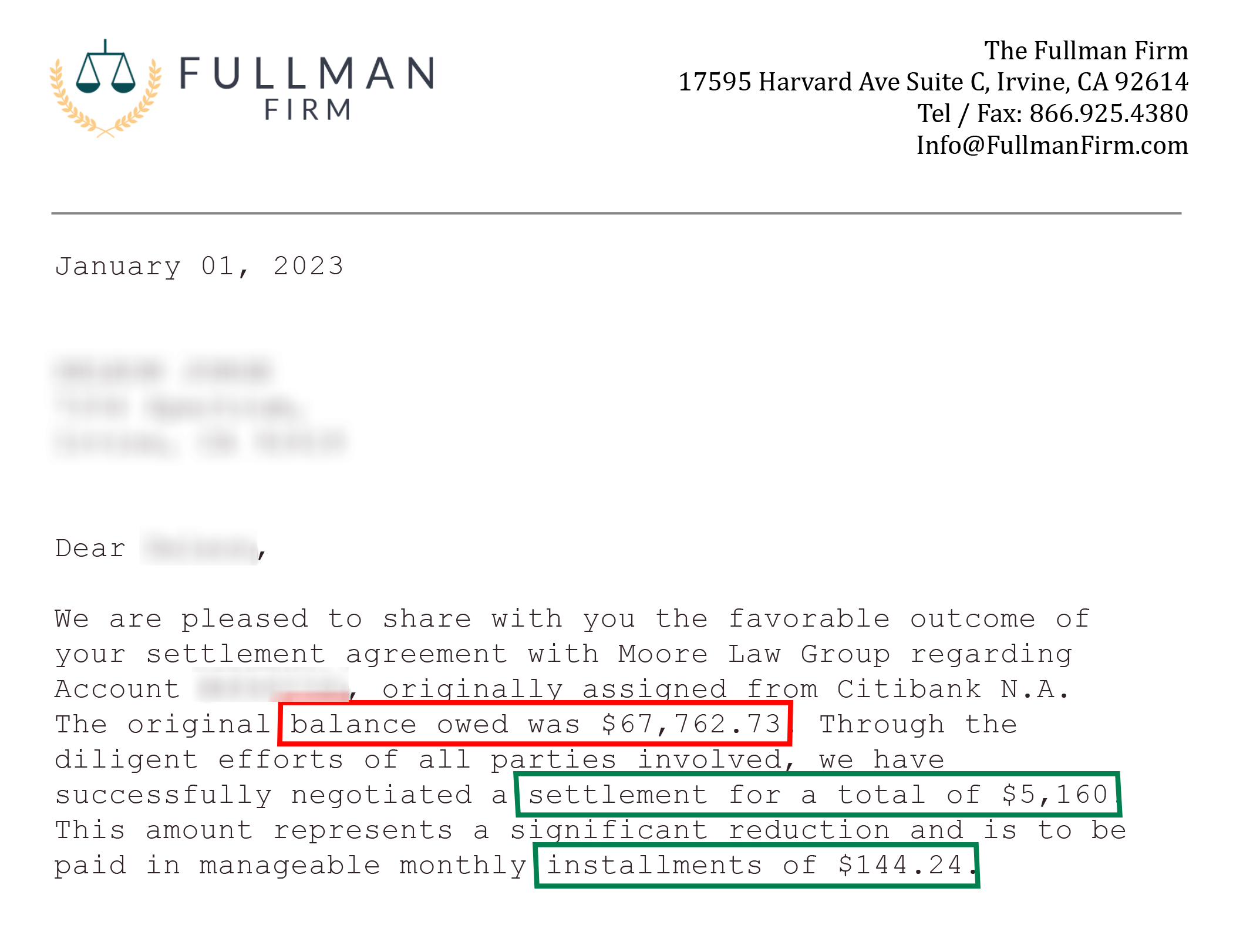

- Negotiation and Settlement: We aim to negotiate with creditors for a favorable settlement or dismissal before trial, saving you time, stress, and potential court fees.

Thousands Helped

Over the years, we’ve assisted thousands of clients in achieving favorable outcomes in debt collection lawsuits, ensuring they regain control of their finances.

Contact Us Today

Don’t face a debt lawsuit alone. Contact The Fullman Firm today for a free consultation. Our experienced attorneys are ready to evaluate your case, explain your legal options, and work towards achieving the best possible outcome for you.

Conclusion

Getting a debt lawsuit dismissed requires strategic planning, legal expertise, and a thorough understanding of consumer protection laws. At The Fullman Firm, we are committed to providing you with the guidance and representation needed to defend your rights effectively. Take the first step towards financial freedom by reaching out to us today.